Description

Join us for this essential webinar designed to equip your organization with the knowledge and tools needed to meet increasingly complex state-level 1099 reporting and compliance obligations. As state audits and penalties continue to rise, understanding the nuances of evolving tax rules and reporting requirements is more critical than ever. This session will provide practical insights into the latest legal developments and compliance strategies, helping you stay ahead of costly enforcement actions.

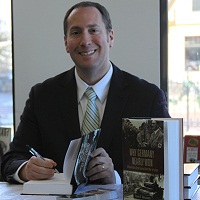

Led by corporate tax attorney and industry expert Steven D. Mercatante, Esq., this quarterly update dives into recent changes in state-level 1099-NEC requirements and common compliance pitfalls. You'll gain clarity on how to determine jurisdictional tax responsibilities, recognize state-specific reporting obligations, and identify potential misclassification issues between 1099 and W-2 workers. Discover actionable best practices that will help your team efficiently manage compliance across multiple states and avoid common mistakes that may trigger audits.

Learning Objectives:-

- Identify key state tax rules that your organization’s staff must understand for proper compliance.

- Receive critical updates on recent 1099-NEC changes implemented at the state level.

- Recognize how to determine which states have jurisdiction over your business operations.

- Compare and contrast the benefits and drawbacks of the Combined Federal/State Filing Program.

- Analyze state-specific 1099 reporting requirements to ensure accuracy and completeness.

- Describe which states have reporting requirements applicable to your organization.

- Address urgent state tax issues, including best practices for managing 1099/W-2 worker misclassification.

By attending this webinar, you'll gain a competitive edge in protecting your organization from potential penalties and improving the efficiency of your compliance processes.

Areas Covered:-

- Overview of state tax rules impacting organizational compliance

- Determining state jurisdiction over your operations

- Recent 1099-NEC changes made by various states

- Pros and cons of the Combined Federal/State Filing Program

- Deep dive into specific state 1099 reporting requirements

- Solutions and best practices for reporting challenges, especially worker misclassification issues

Who Should Attend:-

This session is ideal for finance professionals, compliance officers, tax managers, and payroll specialists responsible for managing state-level information reporting.